Bumper reinforcement damage after collisions is common and requires prompt attention for safety and aesthetics. Insurance policies often cover repairs, especially with comprehensive or collision coverage. Understanding claim processes, policy details, and seeking expert guidance from reputable body shops ensures a smoother experience for bumper reinforcement repair.

Looking to fix your damaged bumper, but wondering if it’s covered by insurance? Bumper reinforcement repair might be easier and more affordable than you think. This article delves into the common types of bumper reinforcement damage and how insurance policies can help. We guide you through understanding coverage limits, navigating claims, and what to expect during the repair process. Learn how to ensure a smooth and stress-free experience with your bumper reinforcement repair.

- Understanding Bumper Reinforcement Damage

- Insurance Coverage for Bumper Repairs

- Navigating Claims: What to Expect

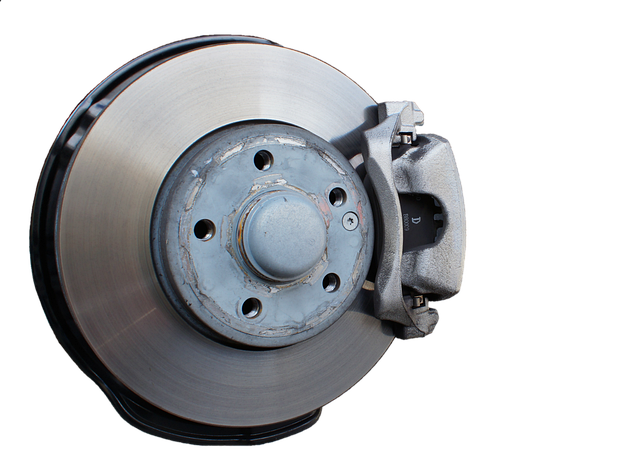

Understanding Bumper Reinforcement Damage

Bumper reinforcement damage can often occur during an automotive collision or accident, leading to a need for bumper reinforcement repair. This type of damage may include cracks, dents, or complete detachment of the bumper from the vehicle’s structure. It’s important to recognize these issues promptly as they not only impact the aesthetic appeal of your vehicle but also play a crucial role in safety features. A well-maintained and intact bumper can significantly enhance the overall structural integrity of a car during a collision.

In the event of an accident, even minor ones, it’s recommended to have your vehicle inspected by a reputable car repair shop. They can accurately diagnose bumper reinforcement damage and suggest the appropriate repairs, whether it involves simple straightening or more complex replacement parts. Keep in mind that some insurance policies may cover these repairs, specifically for Mercedes Benz collision repair or other automotive collision repair services, depending on the circumstances and the terms of your coverage.

Insurance Coverage for Bumper Repairs

Many car owners wonder if their insurance policy covers bumper reinforcement repair, especially after a minor collision or accident. The good news is that bumper repairs are often included in standard auto insurance policies, as they are considered part of comprehensive or collision coverage. This means if you have these add-ons to your policy, and your vehicle experiences damage to its bumper, the cost of the repair might be covered.

When visiting an automotive body shop for bumper reinforcement repair, it’s essential to review your insurance policy details with them. The auto glass repair or collision repair experts can guide you on what specific parts of the process are covered and any potential out-of-pocket expenses. They can also help navigate the claims process, ensuring a smoother experience for car owners in need of bumper repairs.

Navigating Claims: What to Expect

Navigating a claim for bumper reinforcement repair can seem daunting, but understanding the process is key to ensuring a smoother experience. After a vehicle collision repair, especially when it involves structural damage like bumper reinforcement, insurance companies will assess the extent of the damage and determine the cost of repairs. This often requires thorough documentation, including photos and estimates from reputable auto body shops.

During this time, it’s important to keep records of all communications with your insurer and any corresponding paperwork. While collision repair can be expensive, many insurance policies cover these costs, especially if the bumper reinforcement is deemed a safety-critical component. Remember, each insurer has its own procedures, so staying informed and asking questions throughout the process will help ensure a successful claim for bumper reinforcement repair.

If your vehicle has suffered bumper reinforcement damage, understanding your insurance coverage can be a game-changer. By familiarizing yourself with the process and knowing what to expect, you can navigate claims efficiently. Remember, many insurance policies do cover bumper reinforcement repairs, providing relief for these often costly fixes. So, don’t let a damaged bumper leave you in a bind—check your policy and take control of the repair process.