Bumper reinforcement, a crucial safety component, can sustain damage from everyday incidents like minor collisions or debris impact, leading to issues like dents, cracks, and breaks. Comprehensive auto insurance policies may cover these repairs, but the process involves filing a claim, assessment, and communication with insurers. A systematic approach—gathering detailed information, maintaining records, and clear communication—streamlines the claims process for successful reimbursement of bumper reinforcement repair costs.

“Are you wondering if that damaged bumper will put a dent in your wallet? Discover the potential for bumper reinforcement repair coverage under your insurance policy. This comprehensive guide breaks down everything car owners need to know about understanding and navigating bumper repair claims. From common causes of damage to tips for a smooth claims process, learn how to ensure smooth sailing when repairing your vehicle’s crucial front-end component. Uncover the ins and outs of insurance coverage for bumper reinforcement repair.”

- Understanding Bumper Reinforcement and Common Damage

- Insurance Coverage for Bumper Repair: What to Expect

- Navigating the Claims Process: Tips for Successful Reimbursement

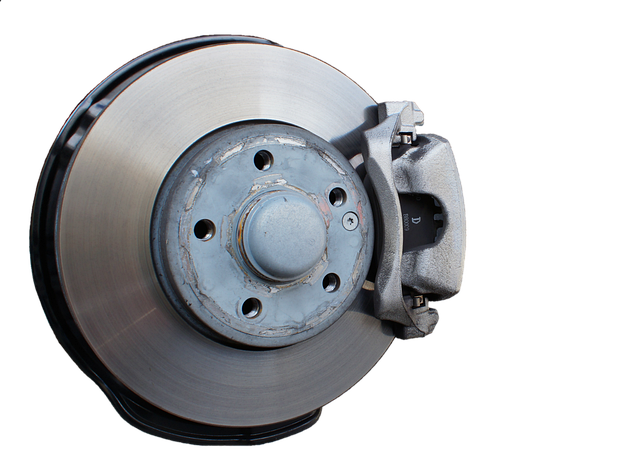

Understanding Bumper Reinforcement and Common Damage

Bumper reinforcement, also known as a bumper bar or front underbody shield, is a crucial component of a vehicle’s safety system. It’s designed to absorb and distribute the impact energy during a collision, protecting the car’s more vulnerable parts and reducing damage. However, like any part of a vehicle, it can sustain damage from various incidents, such as minor collisions, parking mishaps, or even simple nicks and scratches.

Common types of bumper reinforcement damage include dents, dings, cracks, and breaks. These issues often arise from car scratch repair needs due to shopping cart collisions, tree branches, or other debris hitting the bumper. In more severe cases, a car collision repair might be necessary if the reinforcement is completely detached or significantly deformed. Understanding these potential problems is essential as it may lead to questions about whether bumper reinforcement repair is covered by insurance, especially when coupled with comprehensive or collision coverage.

Insurance Coverage for Bumper Repair: What to Expect

When it comes to insurance coverage for bumper repair, specifically bumper reinforcement repair, the details can vary significantly depending on your policy and the circumstances surrounding the damage. Most comprehensive auto insurance policies include some form of coverage for collision-related repairs, including bumper reinforcement repair. This means that if your bumper has been damaged in a collision or accident, your insurance provider might cover a portion or all of the repair costs, subject to deductibles and other policy conditions.

The process typically involves filing a claim with your insurance company, who will then assess the damage and provide an estimate for repairs. Reputable auto collision centers are equipped to handle bumper reinforcement repair, often utilizing specialized equipment and trained technicians to ensure precise and effective vehicle restoration. Remember to keep records of all communications and documents related to the claim process, as this can streamline the entire experience and facilitate a smoother transition towards getting your vehicle back on the road.

Navigating the Claims Process: Tips for Successful Reimbursement

Navigating the claims process for bumper reinforcement repair can be a daunting task, but with the right approach, it can be smoother than expected. The first step is to gather all necessary information related to the damage and the estimated cost of repairs. This includes taking photos of the damaged bumper and getting quotes from reputable collision repair shops. It’s crucial to maintain detailed records of these documents as they will be essential in supporting your claim.

When filing a claim, ensure you communicate clearly with your insurance provider. Explain the extent of the damage caused by the bumper reinforcement and provide all relevant information about the proposed repairs. Many insurance companies have specific procedures for handling such claims, so it’s beneficial to understand these processes and follow them diligently. Remember, keeping thorough records and staying in touch with your insurer can significantly increase the likelihood of a successful reimbursement for your bumper reinforcement repair.

If your vehicle’s bumper reinforcement is damaged, it might be eligible for insurance coverage. Understanding your policy and navigating the claims process can ensure a smooth repair experience. Remember to document the damage, gather evidence, and communicate with your insurance provider for a successful reimbursement. This guide has outlined the key steps, from recognizing common bumper issues to mastering the claims process, empowering you to restore your vehicle’s safety and aesthetics effectively.